Will central banks pivot to easier monetary policy as early as 2024 and what does it mean for bond markets?

Major central banks have finally moved into a genuine data-dependent mode, meaning that the pattern of signaling the outcome of policy meetings well in advance is finally over. While peak rates are at least likely to be close, further hikes certainly cannot be excluded. Only rate cuts are excluded for now.

Financial markets have lately started to contemplate the idea of higher interest rates for longer, which has been illustrated by longer yields heading higher and US yields even making fresh 16-year highs. It is naturally not only the central banks’ outlook that guides long yields. Both the Fed and the ECB are allowing their bond holdings to fall, while public deficits remain sizable, which means private investors need to buy a lot more bonds than has been the case for a long time. Growth expectations have also boosted bond yields, especially as the risk of a US recession is now considered less likely than before. Especially in the US, bond yields may stay above 4% for several years, while a return to the rock-bottom levels that prevailed in the Euro area for a long time is not in sight either.

How are fixed income investors making the most of the high inflation scenario, and what risks lie ahead in 2024?

Headline inflation has continued to decline sharply in basically all western countries. However, this has mainly been due to a decline in energy prices and the stabilization of food prices. At the same time, the decline in core inflation has been much more gradual, and is still clearly above central banks’ targets in many countries.

Looking forward, we expect headline inflation to continue to go down. One explanation for the decline continues to be energy. We build our forecasts around the oil future curve and do not assume the oil price to contribute significantly to inflation numbers in the near term. Even if there are certain supply side limitations that could cause upward pressure on the oil price, we expect the weak global outlook to balance the situation. Furthermore, should volatility in natural gas prices have increased when winter approaches and keeps Europe on its toes, the full gas storages and the long-term weather forecasts expecting a mild winter speak for rather stable energy price expectations.

Another factor limiting inflation is weak global demand, which, together with stable energy prices, have implied that producer price pressures have been and will remain moderate. Thus, goods price inflation is likely to remain stable in the coming quarters.

Labour markets and wage increases will obviously be an important factor driving future inflation. Given that the US labour market only shows rather moderate signs of cooling off and since Euro-area wage agreements with historically high increases have been negotiated in many countries to cover at least the whole of 2024, it seems that wages will boost especially service price inflation significantly also in the future. However, as we expect demand to continue to be weak, we also assume that not all companies can pass on all rising wage costs to their final prices, and we expect that the recent rise in companies’ profit margins will be reversed. This would allow inflation to return to central banks’ targets, despite relatively strong wage increases.

Euro-area GDP has remained almost constant for the past year. Despite the challenges tighter monetary policy is posing to manufacturing and retail sales, for example, the labour market has so far continued to be strong as economic activity has increased in the service sector. However, the most recent PMIs indicate that growth is now also losing momentum in the service sector, which could open the door for lower wage increases and lower inflation. However, that process will be slow due to the centralised wage negotiation system and will require patience from the ECB to not tighten monetary policy too much when tackling stubbornly high inflation.

What advice do you have for fixed income investors to prepare for the possible changes in the markets in 2024?

Soaring inflation in 2022 has shaken the backbone of market valuations, burning fixed income investors fingers and prompting the European Central Bank (ECB) to execute the fastest interest rate hike on record since adoption of the Euro currency.

Following last year sharp selloff and with signs of decelerating inflation across countries, market expectations are now anticipating a plateau of interest rates in the coming months, with the ECB close to end of the hiking cycle. Rates could however stall for a while, with deposits and high quality assets yielding anywhere between 3% and 4%.

This leaves ground to a bitter sweet status quo for credit markets: corporate bonds offer record high yield across rating categories, a welcome ally to outpace still elevated inflation that threatens real returns, but high interest rates could weigh on the overall economic tissue, triggering a recession in the old continent in the quarters to come.

The current backdrop hence calls for investment solutions able to offer an attractive level of yield above 3-4% while at the same time being well equipped to navigate a potential economic slowdown or a deterioration of sentiment within credit.

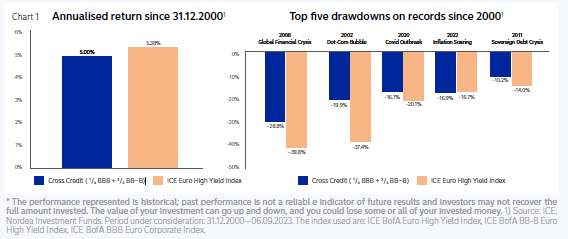

This is precisely what rating buckets in the middle range (BBB, BB, B) can offer relative to the broader credit universe. With its bonds scattered around the boundary between investment grade and high yield segments, the cross credit space is turning increasingly attractive as it comes with a blend of duration and spread risk that offers a balanced risk profile and yet attractive yield.

It is also an investment universe where dispersion has increased tremendously in the recent past, not least due to the high number of rating changes in the last few years. In our view, an active approach in an asset class well positioned to deliver attractive risk adjusted returns has what it takes to be a compelling investment proposition at the current stage.